Cash Transfer Service during COVID-19 pandemic:

Cash Transfer Service is a high and advanced information technology launched by AMB for local and International development organizations, through which conditional and unconditional financial aid is paid directly to the beneficiaries without the need for a bank account, whether through bank branches, service points, or field teams.

This service is developed in response to Yemen difficult humanitarian situation since 2011 as a way that enables donors to deliver dues and financial aids to the beneficiaries in urban and rural areas which aims reduce additional costs the beneficiaries may pay and to protect them from the insecurity situation when moving to city centers to receive their dues and provide a distinguish, safe, fast and reliable service for donors AndThe wide spread of COVID-19 and health and caution procedures that urgently came up imposed a taught reality and challenge in which the bank has to face and overcome all of that with sincere caution to keep the beneficiaries safe and healthy and to do so, the bank implemented a precautionary procedures to limit the spread of the virus among the beneficiaries when executing g cash disbursement process which is implemented through the following methods:

1. Disbursement via Fixed sites:

The Bank and its agent’s permanent and fixed service points / branches and h widespread in districts and Ozals of the Republic, through which beneficiaries can receive their cash assistance.

AMB reached 3,328 payment site through its branches and financial and non-financial agents whom well trained on the procedures related to disbursing cash transfers in light of the spread of the COVID-19 pandemic, taking into their account, safe and appropriate payment sites, sufficiently broad to accommodate beneficiaries without overcrowding, additionally, providing female staff for female beneficiaries’ privacy, and emphasizing on applying the precautionary procedures on both levels ( the workers of the service points and the beneficiaries) to limit or avoid infection spread of the epidemic among them.

2. Disbursement via mobile teams:

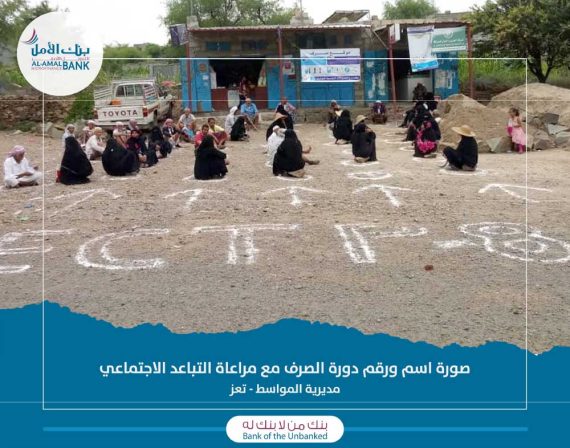

A temporary service points that implement the disbursement process in districts and Ozals where there are no fixed payment sites or in residential communities far from fixed payment sites. AMB has over 600 mobile teams all over the republic who disburse cash transfers in the various targeted districts and the said team includes female staff that serves female beneficiaries to ensure Yemeni women privacy. Those teams received an adequate an adjective training on disbursement procedures during the pandemic situation and taught different ways and methods in who to deal with and how to address any incidents that may arise during the disbursement process.

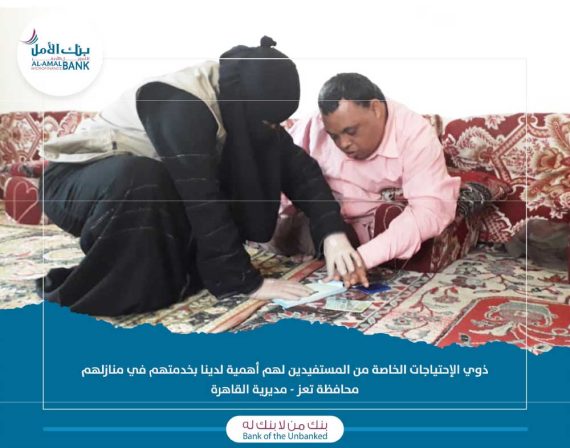

3. Home Outreach Distributions:

Mobile teams provide outreach disbursement service for special cases such as: elderly, disabled, and patients who are unable to reach fixed payments sites or to mobile payment teams in their districts. Home Outreach teams makes home visits to whom are unable to receive their due or cash assistance via fixed sites or mobile teams and AMB consider this service as one of its 's social responsibilities .

Precautionary producers for the disbursement of social transfers during the pandemic:

Al-Amal Microfinance Bank believes in the importance of cash transfer projects funded by local and international organizations, as it is a powerful and effective tool or method in humanitarian relief which focuses on contributing to meet the needs of the targeted communities in terms of Education, health and nutrition during Yemen crisis, As it targets the most vulnerable communities in society. Though, The Bank had to make an action plan and to apply all necessary procedures to continue the implementation of the projects taking in consideration all possible scenarios of what might happen to deal with the epidemic and taking into account maximum protection and safety procedures for employees or workers, beneficiaries and disbursement teams during the distribution of beneficiaries' dues of conditional and unconditional cash transfers .

In this sense, the bank has implemented the precautionary procedures plan that it has been prepared to protect workers and beneficiaries, The mentioned above action plan illustrated in the appendixes attached to this document and has prepared based on four main scopes of work as follows:

1- Administrative activities and banking transactions or services.

2- Mobile distribution for cash-for-work projects.

3- Cash transfers through Banks branches and agents.

The plan addressed outlined details for each scope of work, including, preparations of each disbursement team by providing sterilization materials, masks and gloves, and maintaining social distance during the disbursement of cash assistance. The following is the set of precautionary procedures that has been implemented by the Bank:

1. Raising Awareness about the risks of spreading COVID-19:

Al-Amal Bank issued a set of educational and preventive brochures associated to the risks of spreading COVID-19, distributed in each payment site, published on social media, and circulated on WhatsApp groups dedicated to raise the awareness of the risks of the spread of COVID-19.

2. sterilization:

All service points or disbursement sites instructed by AMB to be committed to the following:

- All cashiers must wear masks and gloves, and use wet finger sponges to count paper money.

- Sanitizing beneficiaries’ hands when entering the disbursement site.

- Using remote temperature monitoring devices to check beneficiaries’ temperature before entering the disbursement site.

- Providing a wet finger sponge in front of the cashiers’ counters for beneficiaries use when counting their paper money.

- Requiring all cashiers to electronic archiving and to be uploaded directly to the Bank's server instead of the paper archive.

3. Social Distance

Al-Amal Bank has contracted 1,000 health care specialists and distributed as one specialist for each disbursement site, moreover, a team of health care supervisors has been formed at the governorate level and deployed on disbursement sites nationwide to supervise and to ensure applying the precautionary procedures of COVID-19 in the field during the disbursement of social cash transfers according to the following:

- Arranging the queues to ensure social distance of 1 meter between each beneficiary and the other.

- Ensure applying sterilization.

- Ensure the availability of sterilization materials.

- Allowing only 2 beneficiaries inside the disbursement site and ensuring that the rest of beneficiaries are waiting outside the disbursement site not inside.

Digital transformation in Al-Amal Bank during the Corona pandemic:

During (COVID- 19), the communications sector is no longer confined to traditional communication and searching for information but it has become the essence of usage data, contents and digital applications by individuals, governments and companies to ensure the continuity and sustainability of economic and social activities in light of new social distance procedures and the full lockdown in most countries around the world.

Digital technologies are fundamentally transforming our economies and countries, making turning point and affecting all sectors, such as agriculture, education, health, governmental and financial services.

Accordingly, Al-Amal Bank has developed PYes service, which is an electronic money service, can be used via smart phones or via SMS in ordinary mobile with the following key features:

• Sufficient for social cash transfer projects with multiple disbursements for beneficiaries.

• Enable beneficiaries to easily withdraw money from the Bank’s branches or agents all over the republic at any time without waiting in queues.

• Depositing beneficiaries' dues or cash assistance to their personal accounts connected to their mobile numbers.

• The beneficiary receives a short message when depositing the amount into his/her account.

• Via PYes application, beneficiariespyescan do the following:

o Cash withdraw or cash out from AMB’s branches or from AMB’s agents’ point of services.

o Money transfer to others or to himself.

o Bill payments (Landline- Mobile- Internet- Water- Electricity)

o Pay for purchase bills from the available and wide spread service points

The electronic money service (PYes) has been used more widely since thepyesfirst confirmed case of COVID-19 in Yemen as it was promoted through the bank's social media platforms, and additionally promoted via e-mail and customer services in the branches of the bank.

Al-Amal Bank has given the priority to the implementation of emergency social cash transfer projects viapyes(PYes) service, thus, the bank helped the beneficiaries to easily receive their dues or cash transfer with no need to visit disbursement sites get crowded during the epidemic and also to easily purchase via PYes app without the need for paper cash circulation / exchange.

With the spread of COVID-19 in Yemen;the electronic financeservice in PYes app has been expanded in relation of (finance / electronic funding service) as it was promoted to the current bank's clients, as well as targeting new customers. The service enables Al-Amal Bank clients to pay the installments via the PYes application, without visiting Bank's headquarters or branches. Moreover, It also enables them to pay mobile, landline and Internet bills, in addition to paying electricity and water bills indoors as well as carrying out many financial operations. Clients can also apply for finance service and to renew it automatically without visiting Bank’s branches.

Challenges and responses to social cash transfer disbursement during the pandemic

The Bank faced many challenges and difficulties in the implementation of social cash transfer projects during the epidemic outbreak, which was a major obstacle to execute the projects smoothly. Nevertheless, the Bank has taken a set of necessary procedures and bearing additional costs to overcome such challenges, to ensure beneficiaries safety, which is the Bank's social responsibility towards beneficiaries. CRM It is dedicated to dealing with customer services, receiving complaints and following up their resolution with the concerned departments. In social transfer projects, the Bank gave it great importance, as it contracted with a group of employees and trained them on the procedures and behaviors of communicating with the beneficiaries, responding to them, following up on solving their problems that occur in the field during the exchange, and working to solve them first-hand, especially during the period of the spread of the Corona pandemic, in the interest of the Bank to The safety of the beneficiaries, as the bank received 78 complaints during the period from April to July 2020.

The Bank was not satisfied with receiving the beneficiaries’ complaints and taking notes on the procedures for disbursing cash assistance in the field and working to resolve them. Rather, it has also adopted mechanisms to verify the integrity of exchange procedures through communication through a unit CRM with samples from the beneficiaries to ensure that they are not exposed to any fraud, violation or failure to apply any of the precautionary measures applied during the pandemic, these communications are also recorded and submitted in daily reports to the concerned departments to take action towards any situation that may occur. These measures contributed to reducing fraud cases that beneficiaries may be exposed to while receiving cash assistance or exploiting the situation of the Corona pandemic to circumvent them.

Al-Amal Microfinance Bank has proven a good ability and experience in dealing with the disbursement of social transfer projects under normal or difficult circumstances such as wars and conflicts, as well as in light of the spread of diseases and epidemics, as the bank implemented many social transfer projects during the Corona pandemic that appeared in Yemen in April 2020 AD.

Thus, the bank has the technical and production capabilities to disburse many social transfer projects in different circumstances and times. The bank also has advanced experience and technological readiness in the exchange business using electronic money via the beneficiaries’ phones and without the need for customers to crowd into fixed or field exchange sites, where every A beneficiary of an electronic account through which he can pay his purchase bills through the spread points of sale, or transfer those amounts from his account and receive them in cash through the bank’s agents spread in all governorates, directorates and isolates of the Republic. With the bank's commitment to reach the special cases that require access, such as cases of disabilities or the elderly who find it difficult even to leave their homes as part of the bank's social responsibility towards them.

All of these works and projects that the Bank is working on help it achieve one of its main goals, which is financial inclusion for all the people of the Republic, expansion of its projects aimed at people with limited income and their financial inclusion, and contributing to reducing poverty.

Corona virus awareness Movies

[Total_Soft_Gallery_Video id=”3″]

If you have any questions

Please contact our team.

Baghdad Street, Sana'a

Yemen

جـميع الحـقوق محـفوظة لـ بنـك الأمـل للتمويل الأصغر 2022©