Financing products and services

The Bank offers many financing products targeting owners of small and micro-enterprises with limited and low incomes and with soft guarantees, in order to facilitate their access to various financial services. The amounts of financing vary from 50 thousand riyals to 20 million riyals.

Financing ceiling:

- Financing starts from fifty thousand to twenty million.

Target group:

- Owners of small and medium enterprises or enterprises.

Features:

- Islamic Murabaha financing.

- Financing in Yemeni riyals

- Takaful insurance for total disability or death

- Flexibility in paying installments

- Grace period of up to 3 months

- Repayment period of up to 24 months

- Payment at bank branches or agents

Terms:

- To be of Yemeni nationality, male or female

- Possess a valid identity document

- Age should not be more than 60 years

- Good credit reputation.

- Providing the necessary guarantees

- Financing does not conflict with Islamic law.

Financing ceiling:

- Financing ranges from 50 thousand to one million riyals

Target group:

- Owners of small and medium enterprises or enterprises.

Features:

- Islamic Murabaha financing.

- Financing in Yemeni riyals

- Takaful insurance for total disability or death

- Flexibility in paying installments

- Grace period of up to 3 months

- Repayment period of up to 24 months

- Payment at bank branches or agents

Terms:

- To be of Yemeni nationality, male or female

- Possess a valid identity document

- Age should not be more than 60 years

- Good credit reputation.

- Providing the necessary guarantees

- Financing does not conflict with Islamic law.

Financing ceiling:

- Financing ranges from 50 thousand to 400 thousand riyals

Target group:

- Small and medium business owners

- Those wishing to obtain household needs (furniture - foodstuffs - clothes ....)

Features:

- Islamic Murabaha financing.

- Financing in Yemeni riyals

- Takaful insurance for total disability or death

- Flexibility in paying installments

- Grace period of up to 3 months

- فترة سداد تصل لـ 12 شهراً

- Payment at bank branches or agents

Terms:

- To be of Yemeni nationality, male or female

- Possess a valid identity document

- Age should not be more than 60 years

- Good credit reputation.

- Providing the necessary guarantees

- Financing does not conflict with Islamic law.

Financing ceiling:

- Financing ranges from 50 thousand - 1.5 million riyals

Target group:

- Employees of government, private and mixed agencies

Features:

- Islamic Murabaha financing.

- Financing in Yemeni riyals

- Takaful insurance for total disability or death

- Flexibility in paying installments

- Grace period of up to 3 months

- Repayment period of up to 24 months

- Payment at bank branches or agents

Terms:

- To be of Yemeni nationality, male or female

- Possess a valid identity document

- Age should not be more than 60 years

- Good credit reputation.

- Providing the necessary guarantees

- Financing does not conflict with Islamic law.

Financing ceiling:

- Financing ranges from 100 thousand - 20 million riyals

Target group:

- Those wishing to obtain financing for agricultural purposes in rural or semi-rural areas.

Features:

- Islamic Murabaha financing.

- Financing in Yemeni riyals

- Takaful insurance for total disability or death

- Flexibility in paying installments

- Grace period of up to 3 months

- Repayment period of up to 24 months

- Payment at bank branches or agents

Terms:

- To be of Yemeni nationality, male or female

- Possess a valid identity document

- Age should not be more than 60 years

- Good credit reputation.

- Providing the necessary guarantees

- Financing does not conflict with Islamic law.

Financing ceiling:

- Financing ranges from 50 thousand - 1.5 million riyals.

Target group:

- Civil retirement employees.

Features:

- Islamic Murabaha financing.

- Financing in Yemeni riyals

- Takaful insurance for total disability or death

- Flexibility in paying installments

- Grace period of up to 3 months

- فترة سداد تصل لـ 36 شهراً

- Payment at bank branches or agents

Terms:

- To be of Yemeni nationality, male or female

- Possess a valid identity document

- Age should not be more than 60 years

- Good credit reputation.

- Providing the necessary guarantees

- Financing does not conflict with Islamic law.

Financing ceiling:

- Financing ranges from 50 thousand - 20 million riyals

Target group:

- Owners of small and micro-enterprises and businesses.

- Employees of government, private and mixed agencies

Features:

- Islamic Murabaha financing.

- Financing in Yemeni riyals

- Takaful insurance for total disability or death

- Flexibility in paying installments

- Grace period of up to 3 months

- Repayment period of up to 24 months

- Payment at bank branches or agents

Terms:

- To be of Yemeni nationality, male or female

- Possess a valid identity document

- Age should not be more than 60 years

- Good credit reputation.

- Providing the necessary guarantees

- Financing does not conflict with Islamic law.

Financing ceiling:

- Financing ranges from 50 thousand - 20 million riyals

Target group:

- Owners of small and micro-enterprises and businesses.

- Employees of government, private and mixed agencies

Features:

- Islamic Murabaha financing.

- Financing in Yemeni riyals

- Takaful insurance for total disability or death

- Flexibility in paying installments

- Grace period of up to 3 months

- Repayment period of up to 24 months

- Payment at bank branches or agents

Terms:

- To be of Yemeni nationality, male or female

- Possess a valid identity document

- Age should not be more than 60 years

- Good credit reputation.

- Providing the necessary guarantees

- Financing does not conflict with Islamic law.

Financing ceiling:

It ranges from 30 thousand to 500 thousand riyals

Target group:

Shopkeepers.

Owners of existing and new enterprises.

PYes Agents.

Features:

Free Financing (Without Murabaha).

Requesting a loan and/or renewal of a loan on cellphone with no need to go to AMB Head Office or branches.

Bank’s Clients do not bear any commission or fees, and the bank's commission is taken from the telecommunications companies.

Installment payment process will be after 3 months and in case the client pay back that installment before the required period of re-payment, he could get the advantage of using his / her balance frequently.

Clients in rural areas can obtain loans without the need of bank field follow up.

It enables the client to obtain new loans in parallel to his existing ones.

It enables the client to provide bill payment services as a new business within his commercial activity.

It provides a typical solution to cope with the cash liquidity shortage.

Terms:

- To be of Yemeni nationality, male or female

- Possess a valid identity document

- Age should not be more than 60 years

- Good credit reputation.

- Providing the necessary guarantees

- Financing does not conflict with Islamic law.

Success stories

Success stories

Client: Musleh Muhammad Janoush

For Musleh, customers who frequent his store help him shape the motifs of the future as he loves to hear the sound of scissors while providing hair cutting services to clients. Clients are attracted by his unique treatment while cutting their hair. Part of the money he earns from the service goes to the shop tenant, which is why Musleh thought about looking for a rented store until he finally got a store on Baghdad Street, Sana'a city. His visit to Al-Amal Bank also became a turning point in the life of his company, as he obtained a loan that enabled him to open his own store. After proving his commitment to repay the loan, Musleh obtained another loan and spent it on the decorations of his shop. As the store looks more attractive than before, more and more customers are coming to have their hair cut. As his income improved, so did Maslih's living conditions. This also encouraged him to open another store in another residential area.

Success stories

Client: Ahmed Abdullah Al-Ghalibi

With a very small capital, Ahmed started his self-financed business selling janabi and making traditional belts. He used to rely on broker's commissions [money] from selling al-Janabi to merchants in the market, which enabled him to maintain business. After Ahmed heard about Al-Amal Bank, he rushed to the office and applied for a loan to develop his business to make a better profit independently of others. The loan amount he got was enough to buy some accessories and products for his shop. This allowed him to improve his income. This success is due to Ahmed's determination. Today, Ahmed is happy with Al Amal Bank and his lending policy. Therefore, it has resorted to promoting Al Amal Bank products and services among its peers who lack the support needed to make a difference in their lives.

Success stories

Client: Bushra Mohammed Al-Roudi

Married to a public servant and mother of three, Bushra lives with her family in a rented house at a time when her husband's salary was not enough to meet the needs of her children. Bushra remembered her profession, "sewing and embroidery", which she had practiced for some time, and this helped her develop the idea of establishing her own project to contribute financially to the well-being of the family and improve their standard of living. After learning about Al-Amal Bank, Bushra approached him, took out a loan and opened her business. I started with a small capital. Although her work was stressful and not profitable, she insisted on continuing the profession. Therefore, she took out another loan to develop her business, and was already able to develop her business and improve the quality of life for her family.

Success stories

Client: Jamil Matar

"I've been for so long, unaware of which resort I should take," Jamil asked after the war halted businesses, closed factories and forced people to flee their homes. "Almost all roads were closed," he recalls, "and continuing to think and think was just a waste of time." Jamil recounted his story as follows: “While I was standing behind those rusty machines, two people who I did not see knocked on the door, and they responded to my greetings with smiling faces. One of them gave me a piece of paper and said,“ We are the Al-Amal Bank team, ”and began explaining to me some of the services provided by the Hope Bank Then I took a long breath and regained the feeling of happiness I had lost for so long. I told them about my need to restart my factory which was closed. I actually took out a loan to reopen my factory and helped me resume production and bring back the smile to its ten workers.

Success stories

Client: Mohamed Muharram Bekele

Muhammad, a father of four, started his success story by obtaining a loan from Al-Amal Bank for his small company "selling sweets, chocolates, biscuits and other needs". His work is aimed at catering to the needs of young children who are unable to go far to buy sweets. Muhammad's business sold well, enabling him to make payments on time. This was the reason for allowing access to three more loans. Apparently, Muhammad's business and quality of life improved.

Success stories

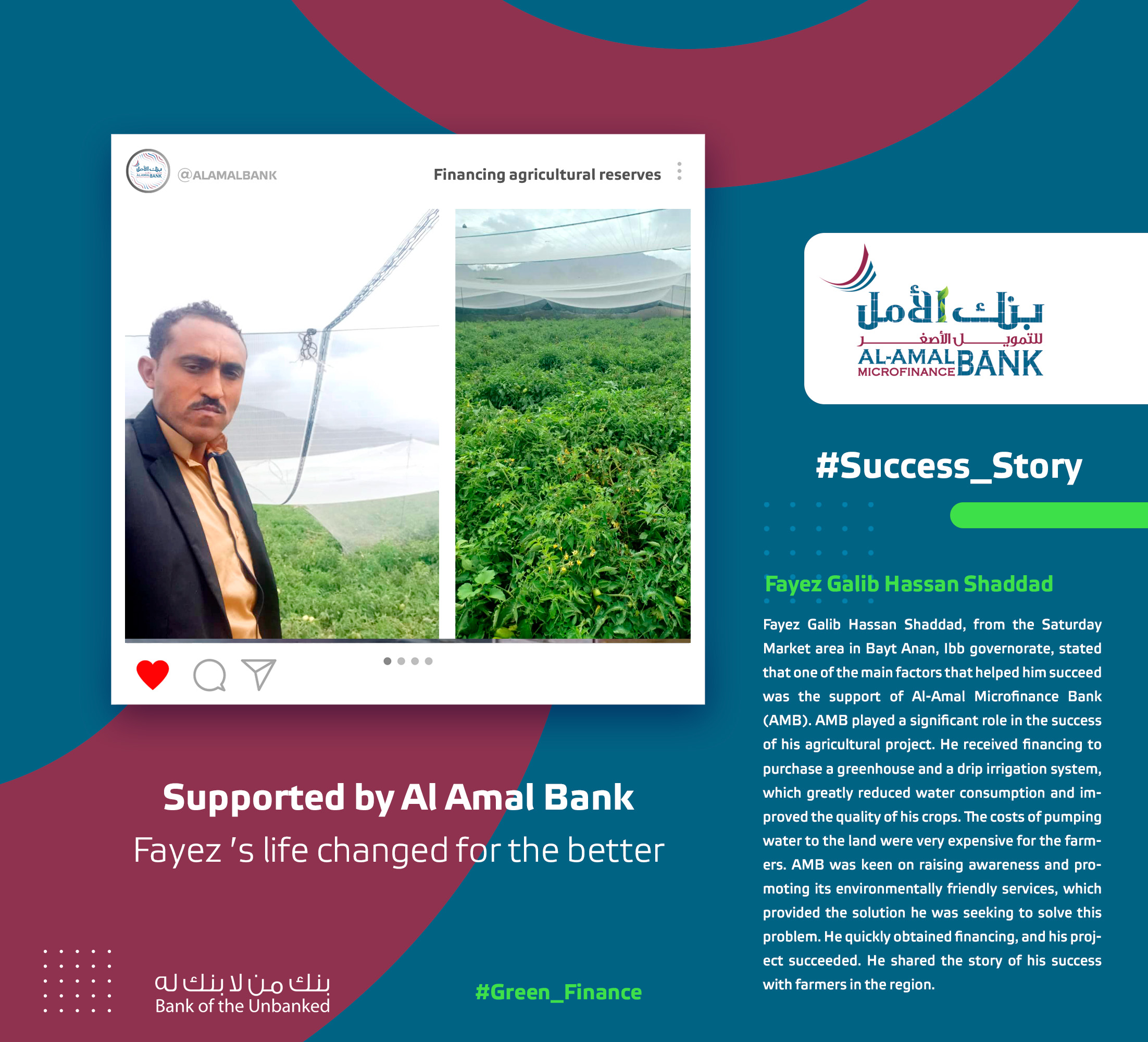

Client: Fayez Galib Shaddad

from the Saturday Market area in Bayt Anan, Ibb governorate, stated that one of the main factors that helped him succeed was the support of Al-Amal Microfinance Bank (AMB). AMB played a significant role in the success of his agricultural project. He received financing to purchase a greenhouse and a drip irrigation system, which greatly reduced water consumption and improved the quality of his crops. The costs of pumping water to the land were very expensive for the farmers. AMB was keen on raising awareness and promoting its environmentally friendly services, which provided the solution he was seeking to solve this problem. He quickly obtained financing, and his project succeeded. He shared the story of his success with farmers in the region.

Success stories

Client: Abdullah Ali Abdo Bayaa

is a seller from the city of Al-Qate', known for their low income. He worked in a vegetable stall, but his activity only provided him with his daily bread due to the small return he got from the vegetable stall. He started with the idea of working on another project, which was upholstering and selling furniture and curtains. He started by contracting with a tailor to start his activity with a very small amount of money. He received a down payment from the customers for the cost of the work in advance to be able to complete and then deliver the goods. The customer's activity expanded to receive orders from outside the region. His financial situation improved, and this is due to the renewal of financing from AMB for his activity more than once.

Success stories

Client: Salam Youssef Abdali

from the city of Al-Qatea, Hudaydah governorate. used to receive low income from buying and selling ready-made clothes and fabrics, she was barely making ends meet. While promoting the services of Al-Amal Microfinance Bank (AMB) in the district. The idea appealed to her, and she applied for a loan from AMB. She was granted the financing to purchase ready-made clothes and open a shop inside her home to generate more sources of income, instead of moving from one place to another. She started working from home, and her financial situation improved.

Success stories

العميل: إبراهيم محمد الدربي

من اهالي منطقة الدرب مديرية أرحب محافظة صنعاء، عانى كثراً حتى قام بتأسيس مشروعة الخاص (مزرعة)، حيث ان أي مشروع ينفذه صاحبه يحمل بين طياته غايات كثيره سواء تحققت على المدى القريب او البعيد؛ ومن الأهداف التي حققها مشروعه هي استخدام أحدث التقنيات في رفع كفاءة الإنتاج الزراعي، واضاف إبراهيم ان اهم العوامل الرئيسية التي ساعدته على النجاح هي دعم بنك الامل للتمويل الأصغر الذي كان له الدور الكبير في إنجاح مشروعه الزراعي حيث تم تمويله لشراء منظومة طاقة شمسية بدل عن مضخة الديزل لسقي المزروعات التي يزرعها، حيث وقام بنشر قصة نجاحة للمزارعين في المنطقة بعد الحصول عوائد مادية ومعنوية وبيئية، وأضاف ان هذه المشاريع تهدف للمحافظة على بيئة نظيفة وتنمية مستدامة.

Al-Amal Microfinance Bank's Profile

Al-Amal Bank has completed ten years of dedication and great efforts, thus achieving excellence, leadership and innovation.

Al-Amal Microfinance Bank's Brochure

Al-Amal Bank is a non-profit organization that seeks to provide sustainable financial services to families with limited and low incomes in Yemen, especially people who have small and micro income-generating projects.

Our partners

Quick links

Contact Us

If you have any questions

Please contact our team.

Baghdad Street, Sana'a

Yemen

جـميع الحـقوق محـفوظة لـ بنـك الأمـل للتمويل الأصغر 2022©