The first microfinance bank in Yemen and the MENA region

Al-Amal Microfinance Bank is a non-profit financial institution (that does not distribute dividends to shareholders) that seeks to provide sustainable financial services to low-income families in Yemen, especially owners of small and micro enterprises

Electronic money

Pyes app saves your money and helps you manage your e-accounts

Social Transfer Service

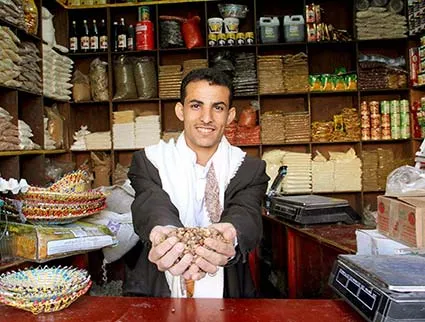

We will be happy to help you obtain financing for your projects

Make your dream and ambition to develop your project become a reality. Al Amal Microfinance Bank offers a range of financing products that are suitable for all customer segments in accordance with the controls and provisions of Islamic Sharia.

Financing grows your project

A thriving business is essential to the growth of our world, which is why we are committed to partnering with you to meet your financing needs. We will share your vision and work with you to achieve it.

Alamal Products and Services

The Bank offers many financing products targeting owners of small and micro-enterprises with limited and low incomes and with soft guarantees, in order to facilitate their access to various financial services. The amounts of financing vary from 50 thousand riyals to 20 million riyals.